Get started with our free demo portal to manage your entity or set up your local business with ease.

We begin by helping you choose the right business structure, whether it’s a sole proprietorship, a private limited company (OÜ), or a branch for your overseas company in Estonia. By assessing your strategic goals, we ensure your structure aligns with both your operational needs and long-term vision. This choice is crucial, influencing tax obligations, liabilities, and operational flexibility.

Once the optimal structure is selected, we assist with all necessary filings to the Estonian Business Register. This includes registering your business name, securing any required trade licenses, and applying for a VAT number. We ensure each registration step aligns with Estonian business legislation and local requirements.

Our entity management services go beyond registration to include ongoing compliance support with Estonian regulations. We handle annual filings, tax compliance, payroll administration, and tailored administrative solutions to support your business’s growth. Our dedicated support team is always available to address inquiries, update you on regulatory developments, and tackle any challenges in expanding your business.

We provide more than just registration; we deliver a comprehensive solution that lets you focus fully on scaling your venture. With our deep expertise, you can enter the Estonian market confidently, knowing all setup and maintenance aspects are managed by professionals. Expanding internationally or launching a new business in Estonia becomes seamless, with end-to-end support at every step.

Choosing a name for your Estonian OÜ (Osaühing) is a vital step in establishing your business identity. Your business name should encapsulate the essence of what you do while being memorable for your customers. It should align with your brand image and effectively convey the right message to your target audience. A well-thought-out name can significantly enhance recognition and foster trust in the marketplace.

When selecting a name, it’s essential to comply with Estonian legal requirements. Your chosen name must be unique and not too similar to existing businesses. The Estonian Business Register allows you to verify the availability of your desired name, ensuring that it meets all necessary criteria. If a name is already in use or too similar to another, it will be rejected, making this early check crucial.

Additionally, the name must include "OÜ" to signify its legal structure as a private limited company. This informs potential partners, clients, and customers of your business’s operating status. Avoid using any misleading terms that could imply government affiliation or misrepresent your business’s nature.

If your business aims to expand internationally, consider choosing a name that is easy to pronounce and understand in various languages to prevent confusion. It's also wise to check the availability of a matching domain name for your online presence, ensuring a cohesive brand identity across platforms. A creative and well-researched name will set the stage for your business's success in Estonia and beyond.

An Estonian OÜ (osaühing) is a favored legal structure for businesses due to its flexibility concerning shareholders and capital requirements. This structure enables the company to be privately owned, with shares allocated among shareholders who enjoy specific rights, including voting on crucial business decisions and receiving dividends proportional to their ownership.

A key advantage of forming an Estonian OÜ is the absence of a minimum capital requirement. Since recent reforms, Estonia has made it easier for entrepreneurs and small businesses to establish an OÜ without the constraint of a significant initial investment. This accessibility allows new ventures to launch and thrive without the burden of substantial startup costs.

Shareholders in an Estonian OÜ can include both individuals and legal entities, whether domestic or international. The company must have at least one shareholder, and shares are not publicly traded. This model of private ownership provides greater control over the business, as shares are typically held by a select group of investors or family members. With a streamlined registration process and business-friendly regulations, Estonia is an ideal location for aspiring entrepreneurs looking to establish a solid foundation for their ventures.

In an Estonian OÜ (Osaühing), shareholders enjoy the significant advantage of limited liability, meaning their financial risk is primarily confined to their investment in the company. This structure effectively shields personal assets from the company's debts and liabilities. In the event that the OÜ faces financial challenges or legal action, shareholders are generally not held responsible for the company’s obligations beyond their initial capital contribution.

However, limited liability isn't without exceptions. Shareholders may still encounter personal liability in specific situations, especially if they are deemed to have acted unlawfully or irresponsibly. For instance, if shareholders neglect corporate governance standards or engage in fraudulent behavior, the legal veil of the company can be pierced, making them personally accountable for the company's debts.

The legal framework governing an Estonian OÜ mandates sound financial management and transparency in accounting practices. Shareholders must ensure that the company maintains precise financial records and meets all statutory requirements. Neglecting these responsibilities can lead to liability for unpaid taxes or penalties, which may also extend to shareholders if the company is found negligent in its financial operations.

Moreover, Estonian law offers robust protections for minority shareholders. Regulations are in place to prevent majority shareholders from abusing their power, ensuring that the rights of minority interests are upheld. Minority shareholders have access to vital information, a say in decision-making, and safeguards against unfair treatment, enhancing their standing within the company.

The articles of association of an Estonian OÜ delineate the rights and responsibilities of shareholders, including provisions related to governance and decision-making processes. These foundational documents provide an additional layer of legal protection by clearly defining roles and responsibilities, thereby minimizing the potential for disputes.

With its favorable business environment and strong legal protections, Estonia provides a compelling option for entrepreneurs seeking to establish a limited liability company that balances risk with opportunity.

Seamless registration services are designed to simplify the journey of establishing a business, allowing entrepreneurs in Estonia to concentrate on what they do best. These services encompass crucial steps such as registering a business name, acquiring necessary licenses, and obtaining tax identification numbers. By offering a streamlined process, these services significantly reduce the complexities often faced when starting a business.

Clients engaging with seamless registration services can anticipate personalized support tailored to their unique requirements. This includes consultations that delve into the specific needs of various business structures, whether it’s a sole proprietorship, partnership, or limited liability company (OÜ). Experts guide clients through the essential documentation and legal obligations, ensuring adherence to Estonian regulations.

A standout feature of seamless registration services is the incorporation of technology to boost efficiency. Many providers utilize user-friendly online platforms that enable clients to submit documents, monitor progress, and receive real-time notifications. This digital approach accelerates the registration process while minimizing the risk of errors or omissions that could hinder approval.

Furthermore, these services often include comprehensive packages that extend beyond initial registration. This ongoing support can cover annual filings, structural changes, and updates to licenses or permits, ensuring businesses remain compliant as they evolve.

Seamless registration services also provide insights into Estonia's specific regulatory landscape, helping entrepreneurs navigate the complexities of their industry. Understanding these nuances is crucial for avoiding potential pitfalls and fostering sustainable growth. Access to expert guidance can prove invaluable in maintaining compliance and making informed decisions.

Ultimately, seamless registration services create a positive experience for entrepreneurs by alleviating stress and uncertainty. By managing the administrative aspects of business registration, these services empower clients to focus their efforts on building and expanding their enterprises in Estonia effectively.

Fill out the form below to register.

Registering your company with the Estonian Business Register is a vital step in establishing your business in Estonia. The Business Register acts as the official registry for all enterprises in the country, ensuring that businesses operate transparently and comply with legal requirements. This registration provides essential information about your company to the public, including its legal structure, activities, and financial status.

To kick off the registration process, gather all necessary documents. Typically, you will need a valid identification document, your business plan, and details about the shareholders and directors. It's important to clearly outline the business activities you plan to engage in, as this will determine your company’s classification within the Estonian system.

Once you have your documents ready, you can submit your application online through the Estonian Business Register portal or schedule an appointment at a local service office. During this appointment, a representative will assist you through the registration process. You'll need to complete the registration form and provide the required documentation. The Business Register will then verify your information to ensure everything is in order.

Upon successful registration, your company will receive a unique registration number, serving as your official business identity within the Estonian system. This number is essential for various administrative purposes, including tax filings and opening a business bank account. You will also receive an official extract from the register, which can be used as proof of your company’s existence.

After registration, it is crucial to keep your Business Register information up to date. Any changes in your company structure, such as modifications in directorship, shareholding, or business activities, must be reported promptly. This ensures compliance with Estonian regulations and maintains the accuracy of the public registry, reinforcing your business’s credibility in the marketplace.

Compliance with Estonian employment laws is essential for an Osaühing (OÜ) to operate efficiently and avoid legal complications. A fundamental aspect of Estonian employment law is the necessity of written employment contracts. These contracts must clearly define the terms of employment, including job responsibilities, salary, working hours, and termination conditions. A well-crafted contract fosters a mutual understanding of rights and obligations between employers and employees.

Another critical component is adherence to minimum wage regulations. Employers are required to pay their employees at least the statutory minimum wage, which is updated regularly. This requirement applies to all employees, regardless of age or employment status, and failure to comply can lead to substantial fines and legal challenges. Employers should stay updated on wage regulation changes to ensure ongoing compliance.

Estonian employment laws also prioritize statutory leave entitlements, such as vacation days, sick leave, and parental leave. Employers must diligently track these entitlements and ensure employees can take their leave without facing negative repercussions. Not granting these leaves can result in legal ramifications and damage the company’s reputation.

Additionally, employers in Estonia must comply with regulations regarding working hours and conditions. The Working Time Act outlines rules related to maximum working hours, rest periods, and overtime compensation. Implementing policies that align with these regulations promotes a healthy work environment and helps prevent labor disputes, allowing businesses to thrive.

Understanding Estonia's corporate tax system is essential for any business looking to thrive in this innovative landscape. One of the standout features is its unique corporate tax structure. Instead of a standard corporate tax rate on profits, Estonia employs a deferred tax system, where corporate income is only taxed when profits are distributed as dividends. This means businesses can reinvest their earnings without immediate tax implications, fostering growth and innovation.

A significant advantage for Estonian companies is the participation exemption, which allows them to receive dividends and capital gains from subsidiaries tax-free, provided they hold at least 10% of the shares. This encourages companies to invest and expand internationally without facing additional tax burdens on repatriated profits.

Estonia also streamlines its filing requirements. Corporations must submit their annual tax returns by the end of the financial year, simplifying the process for businesses. The digital infrastructure in Estonia allows for efficient tax filings, making compliance straightforward and less time-consuming.

The Estonian tax system is designed to promote innovation and sustainability. For instance, there are various incentives available for companies engaged in research and development activities, providing additional tax relief and encouraging investment in new technologies.

For businesses operating across borders, international taxation considerations are crucial. Estonia has established a robust network of tax treaties that help mitigate double taxation and clarify tax obligations in various jurisdictions. Companies should also be aware of transfer pricing regulations, ensuring that inter-company transactions are conducted at arm's length.

To effectively navigate the complexities of Estonia's corporate tax environment, engaging local tax advisors is highly beneficial. These professionals offer valuable insights into compliance, strategic tax planning, and the implications of recent tax reforms, helping businesses optimize their tax position and make informed decisions in this dynamic marketplace.

An OÜ (Osaühing) in Estonia is subject to various ongoing obligations concerning financial reporting and auditing. These requirements ensure transparency, accuracy, and compliance with Estonian corporate law. Here’s a look at some of the essential aspects:

An Estonian OÜ must prepare and file annual financial statements. These statements should be completed within six months of the financial year-end and must be approved by the shareholders within three months. The financial statements typically include a balance sheet, profit and loss account, and notes that clarify the financial data. Non-compliance can lead to penalties and potential legal repercussions for the directors.

Once the financial statements are approved, they must be submitted to the Estonian Business Register within 30 days. The size of the OÜ (small, medium, or large) influences the level of detail required in the publication. For instance, small OÜs can file simplified financial statements and are exempt from providing a full balance sheet. Failing to meet these obligations may result in fines or legal consequences.

The requirement for an audit of an OÜ's annual financial statements depends on its size. Large OÜs are mandated to have their financial statements audited by an independent, certified auditor, while medium-sized and small OÜs are generally exempt from this requirement. The auditor’s role is to verify the accuracy of the financial statements, ensuring they present a true and fair view of the company’s financial status.

By adhering to these obligations, Estonian OÜs can maintain compliance and foster trust among stakeholders, paving the way for sustainable growth and business success.

The Estonian OÜ (Osaühing), a private limited liability company, stands out for its remarkable flexibility in structuring, enabling businesses to customize their operations and governance according to their unique needs. This adaptability arises from minimal capital requirements, extensive shareholder rights, and a customizable governance framework. Companies can effortlessly modify their shareholding, capital distribution, and decision-making processes, making the Estonian OÜ an appealing choice for both small and large enterprises seeking operational agility and opportunities for international growth.

Identify the shareholders and their ownership percentages. The Estonian OÜ permits one or more shareholders, who can be individuals or legal entities. This offers great flexibility in determining who will control the company.

The articles of association define the governance of the OÜ, detailing management, voting rights, and dividend policies. These documents can be tailored to align with the specific preferences of shareholders and management, ensuring a customized operational framework.

The structure allows for the appointment of directors with varied roles and responsibilities. An OÜ can include both executive and non-executive directors, offering flexibility in management and oversight.

There is no minimum capital requirement for establishing an Estonian OÜ, providing considerable freedom in how the company’s capital is structured. Shares can be issued with or without voting rights, and various classes of shares can be created to suit business needs.

Shareholders have the liberty to customize voting rights within the OÜ. Different classes of shares may carry distinct voting powers, and certain decisions may necessitate a higher voting threshold, enhancing governance flexibility.

Once the structure is defined, the OÜ must be registered with the Estonian Business Register. The company’s details, including the shareholder structure, need to be formally documented, establishing its legal presence.

After registration, the OÜ must adhere to Estonian corporate regulations, including annual reporting and tax obligations. The company is required to follow its articles of association while complying with local laws, which ensures continued operational flexibility.

This structural adaptability makes the Estonian OÜ an enticing option for entrepreneurs and investors, providing a robust foundation for growth and innovation.

Leveraging a virtual office address for your Estonian OÜ (osaühing) can be a savvy and efficient strategy, especially for startups and small businesses. This setup enables you to establish a professional business presence in Estonia without the overhead of a physical office. The significant reduction in operational costs makes it an appealing choice for companies looking to penetrate the Estonian market.

One of the primary advantages of a virtual office is the provision of a professional business address, which boosts your company’s credibility. This aspect is vital when engaging with Estonian clients or partners who expect a local footprint. Furthermore, a virtual office allows you to maintain privacy by keeping your personal address separate from your business dealings.

Beyond credibility, a virtual office also helps fulfill legal requirements for establishing an OÜ. Estonian law stipulates that an OÜ must have a registered address in the country. A virtual office meets this criterion, enabling businesses to comply with local regulations without the need for leasing or purchasing physical office space.

Many virtual office services come with added features like mail forwarding and phone answering, which can significantly enhance your business operations. This ensures that you never miss vital communications, even when working remotely. Additionally, several virtual office providers offer access to meeting rooms and coworking spaces, providing a professional environment for client or partner meetings as needed.

For internationally operating businesses, utilizing a virtual office in Estonia simplifies cross-border transactions. Establishing a local point of contact makes it easier to cultivate relationships with Estonian customers, suppliers, and partners. This local presence can also open doors to Estonian business networks and resources.

A virtual office can also serve as a tax-efficient option. By having a registered Estonian address, your OÜ may access various local tax benefits or deductions. Estonia is known for its favorable corporate tax environment, making this arrangement particularly attractive.

Flexibility is another key benefit of a virtual office. Whether you’re exploring new markets or adjusting your operations, a virtual office allows you to pivot swiftly without the constraints of physical office leases. This adaptability is invaluable in today’s fast-paced business landscape.

In terms of administrative efficiency, a virtual office can streamline operations. Many providers offer digital tools to manage mail, appointments, and communications, enabling you to concentrate on essential business functions. This convenience is a significant time-saver for entrepreneurs and managers alike.

In summary, employing a virtual office for your Estonian OÜ is a cost-effective and flexible solution that enhances your company’s professionalism, compliance, and overall operational efficiency.

Registering an Estonian OÜ (Osauhing) can be a complex journey, especially for foreign entrepreneurs unfamiliar with Estonian regulations. Partnering with local experts streamlines the process, ensuring compliance with all legal requirements and offering valuable insights into the Estonian market. These professionals guide you through the necessary paperwork, verify documentation, and liaise with Estonian authorities, allowing you to concentrate on your business. Their expertise makes the registration process faster, smoother, and more efficient, helping you avoid costly mistakes or delays.

Consult with Local Experts: Engage with consultants specializing in Estonian OÜ registration to fully understand the requirements, procedures, and potential hurdles. They will outline each step and provide an initial assessment tailored to your business needs.

Gather Necessary Documentation: With expert guidance, prepare essential documents, such as your business plan, shareholder details, and proof of identification. Local professionals ensure all paperwork meets Estonian standards.

Choose a Company Name and Verify Availability: Local experts assist in selecting an appropriate company name and checking its availability with the Estonian Business Register to avoid conflicts.

Draft and Notarize Articles of Association: Work with an Estonian notary to draft and notarize the articles of association, as required by law. Local consultants ensure these documents align with Estonian legal norms and your business objectives.

Open an Estonian Bank Account: Local experts facilitate the opening of an Estonian business bank account, a crucial step for depositing the required share capital. They streamline communication with banks to make the process smoother.

Register with the Estonian Business Register: Once all documents are prepared, your local experts will assist you in submitting the registration to the Estonian Business Register, ensuring all details are accurate to avoid delays.

Obtain Tax Identification and Compliance: After registration, local consultants will help you apply for an Estonian VAT number and ensure your business complies with local tax laws. They can also provide advice on ongoing reporting and compliance requirements.

With local expertise, registering your Estonian OÜ becomes an efficient and rewarding experience, paving the way for your business success in Estonia.

Leveraging technology in business registration services has transformed the landscape, making the process not only more efficient but also more accessible than ever before. Gone are the days of cumbersome paperwork, lengthy waiting periods, and repeated trips to government offices. Today, the integration of digital platforms allows entrepreneurs to register their businesses online, significantly reducing the time and effort required to launch a venture in Estonia.

A standout benefit of this technological advancement is the automation of various processes. Automated systems provide a step-by-step guide through the registration process, ensuring that all necessary forms and documentation are completed accurately. This automation minimizes human error, enhancing the overall reliability of the submitted information.

Cloud-based solutions have been instrumental in modernizing Estonia’s business registration services. Entrepreneurs can securely store and retrieve essential documents online, giving them the flexibility to access their registration details from any location at any time. This convenience fosters a more user-friendly experience.

The introduction of e-signatures has further revolutionized document handling during the registration process. By eliminating the need for physical signatures, e-signatures expedite approvals and significantly reduce reliance on traditional paper-based methods, which often lead to delays.

Technology has also enhanced the transparency of business registration in Estonia. Entrepreneurs can track the status of their applications in real-time, fostering trust in the system and keeping businesses informed about any potential delays or additional documentation requirements.

Artificial intelligence (AI) plays a pivotal role in streamlining the registration experience. AI tools can review submitted documents for compliance with regulatory standards, ensuring they meet all necessary requirements before submission. This preemptive analysis saves time and reduces the likelihood of rejection.

Additionally, the incorporation of online payment systems into registration platforms facilitates seamless fee transactions. Entrepreneurs can pay their registration fees digitally, eliminating the need for outdated payment methods like checks or cash.

Most importantly, technology has made business registration more accessible to small businesses and startups across Estonia. Entrepreneurs from even the most remote areas can easily access registration services without the need to travel, promoting business growth and fostering economic development throughout the region.

With these innovations, establishing an OÜ (osaühing) has never been easier, empowering entrepreneurs to bring their ideas to life in Estonia's dynamic business landscape.

An OÜ (Osaühing) is a private limited liability company that offers numerous advantages for both local and foreign entrepreneurs in Estonia. It's the most prevalent business structure in the country, known for its flexibility, limited liability for shareholders, and clear regulations. An OÜ can be established with a minimum share capital of just €2, making it highly accessible for small businesses and startups. Shareholders are only liable up to the amount of their shares, ensuring personal financial protection. Additionally, an OÜ benefits from favorable tax treatments and the ability to attract investors through shares.

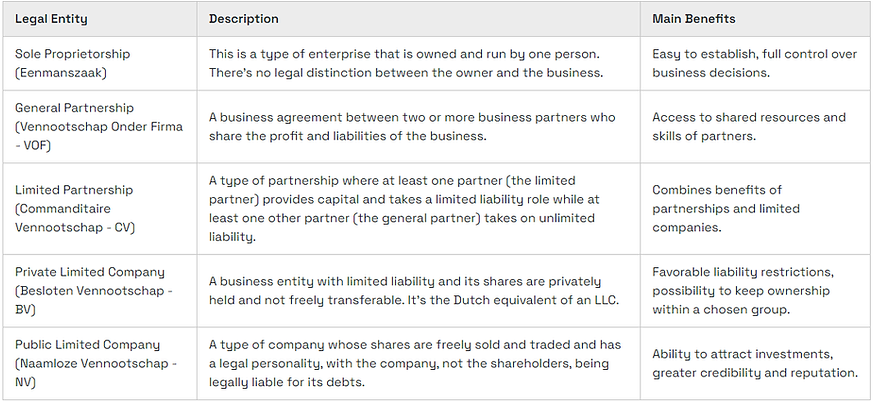

OÜ vs. Sole Proprietorship: The primary distinction between an OÜ and a sole proprietorship lies in the level of liability. In a sole proprietorship, the owner is personally liable for all business debts and obligations, putting personal assets at risk in case of financial difficulties. Conversely, the OÜ limits liability to the company itself, safeguarding shareholders from personal financial risk. Moreover, an OÜ offers more opportunities for tax planning, whereas sole proprietorships tend to be simpler to establish but may incur higher personal tax rates.

OÜ vs. Public Limited Company (AS): The public limited company, known as AS (Aktsiaselts), is another popular business structure, mainly used by larger corporations. Unlike an OÜ, which is privately held, an AS can issue shares to the public and be listed on the stock exchange, making it ideal for larger companies seeking to raise capital through public offerings. However, an AS requires a higher minimum capital investment of €25,000, and its administrative obligations are more complex. On the other hand, the OÜ is often favored by small and medium-sized enterprises (SMEs) due to its straightforward setup and lower capital requirements.

OÜ vs. Partnership: A partnership, such as a general partnership or a limited partnership, is also a common business structure in Estonia. In a general partnership, all partners share personal liability for the business's debts, akin to a sole proprietorship. A limited partnership, however, protects limited partners from personal liability, though general partners remain fully liable. In contrast, the OÜ provides a shield of limited liability for all shareholders. Partnerships may be chosen for simpler operations or family businesses, while an OÜ is more suitable for companies looking to grow, attract investors, or expand internationally.

Am I prepared to launch my Entity?

I am prepared to begin trading.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!